It looks like two of the most important and influential ETFs in the Nasdaq 100 are forming a new bullish outlook, and it could create big waves in the market going forward. The Communication Services sector ETF (XLC) and the Transports sector ETF (IYT) have both started to display a more favorable sentiment in the markets, resulting in positive price action and increased volume.

The Communication Services sector ETF XLC has recently broken out above its long-term resistance level, and this could be an indication of stronger trends in the sector, as well as potentially higher highs. Although the Transports sector ETF IYT has yet to break out above its long-term resistance level, it has been showing strong signs of accumulation and has been able to hold its gains well. This could be the beginning of a major breakout, with increased participation in the sector resulting in higher prices.

The bullish sentiment in the Nasdaq 100 is being driven by strong performances in the technology sector, along with the expanding economy. Stronger consumer sentiment is likely playing a role in the Communication Services sector, as this sector contains several companies that have been well positioned to benefit from the lockdowns and stay-at-home orders issued due to the pandemic. Similarly, the Transports ETF could be experiencing a bout of bullish sentiment due to the recovery in the global economy, and the Christie administration pushing for more infrastructure investment in the US.

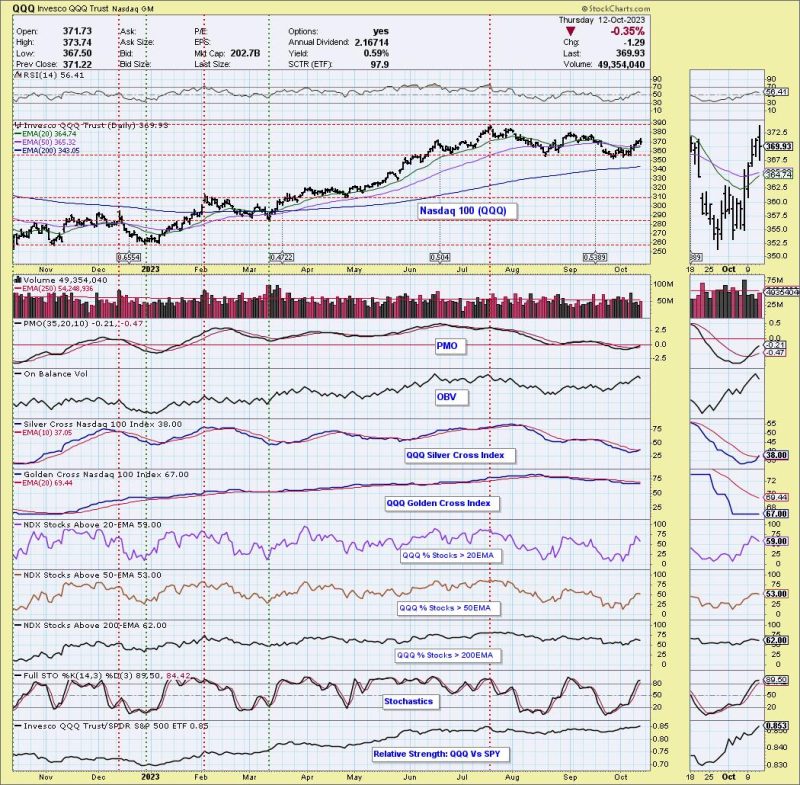

The Nasdaq 100 ETF (QQQ) is also experiencing bullish sentiment, as it is up 12% from its March 2020 lows. Although the Nasdaq 100 is still trading below its all-time highs, it could enter into a new bull market when it breaks out of its long-term resistance level. If these ETFs are any indication of the broader market trend, the Nasdaq 100 could be on the verge of breaking out into a new bull market.

This is an exciting time for investors as both the Communication Services sector ETF (XLC) and the Transports sector ETF (IYT) have revealed a new bullish bias in the market. Investors will need to remain cautious and keep an eye on the price action of these ETFs to ensure they capitalize on the potential gains ahead.