Title: Zinc Price Forecast: Top Trends influencing Zinc Market in 2024.

Introduction

In a dynamic global economy, any resource’s value fluctuates based on demand and supply, market sentiments, and various macro and microeconomic factors. Among these resources, Zinc, a key element used in industries such as construction, automobile, and electronics, is witnessing a shift in its market value. This article explores the anticipated trends affecting zinc prices and provides a comprehensive forecast for 2024.

The Current State of the Zinc Market

As of today’s stance, the zinc industry is gradually recovering from the impact of the COVID-19 pandemic, which resulted in a significant disruption of production functions and supply chains around the world. The resilience of the zinc market has been observed, but scrutiny remains critical as we advance towards 2024.

Trends Influencing Zinc Prices in 2024

There are three key trends to consider when predicting zinc prices in 2024:

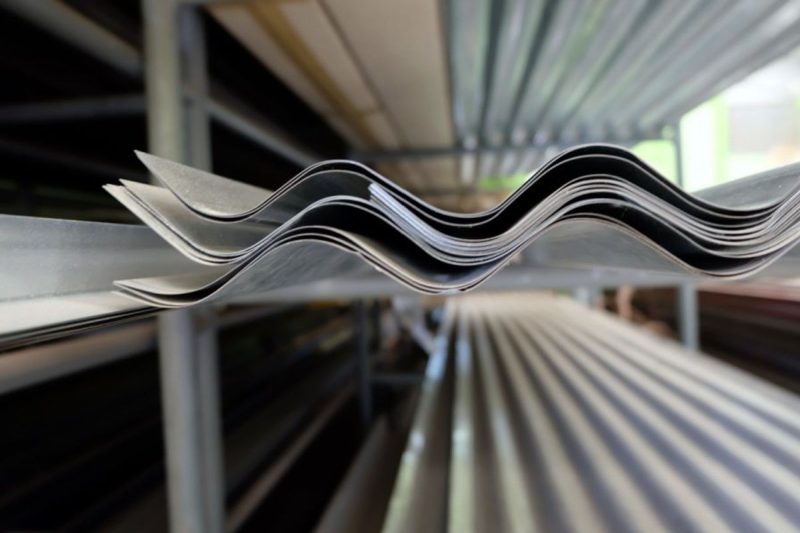

1. Shift Towards Green and Sustainable Construction: Globally, there has been an increased emphasis on sustainable, eco-friendly construction practices. Zinc, being a versatile and recyclable metal which reduces environmental footprints, sees rising demand, particularly in developed economies. This trend is set to continue up until 2024 and will significantly influence zinc prices.

2. Rapid Industrialization in Emerging Economies: Developing countries such as India and China are seeing a surge in infrastructure development and urbanization, driving up the demand for zinc. As these countries continue to industrialize, zinc demand and consequently its price, will most likely rise significantly by 2024.

3. Innovation in Zinc Battery Technology: The energy sector’s focus shifting towards renewable sources brings zinc into the spotlight, where it serves as a key component of zinc-air batteries. With more R&D being injected into this pioneering technology, increasing employment of zinc batteries could support the upswing in zinc prices by 2024.

The Forecast Scenario

Assuming steady economic growth, an advancement in zinc battery technology, and considering countries’ sustained efforts towards greener construction and rapid industrialization, the zinc demand is expected to surge, pressurizing its supply.

Yet, zinc is not an infinite resource. Overexploitation and dwindling ore qualities could pose severe challenges to meet this surging demand, thereby applying an upward pressure on its prices.

In the light of these trends, the forecast for zinc prices up to 2024 seems bullish. However, this prediction isn’t exempted from uncertainties. Factors like geopolitical tensions, possible trade wars, and unexpected technological breakthroughs could sway the market trajectory in unforeseen ways.

Conclusion

In conclusion, the year 2024 will likely witness a climb in zinc prices based on current market movements and predicted trends. Market participants must keep a close watch on influencing factors such as sustainable construction trends, industrial development, and advancements in zinc battery technology to make informed decisions. As always, the volatility of the global economic scene calls for regular market analysis and prudent forecasting techniques.