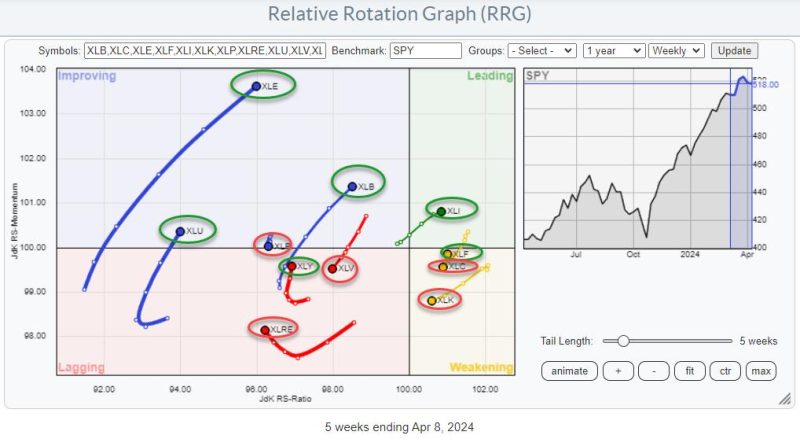

RRG or Relative Rotation Graphs are dynamic visualizations that provide insight into trends and rotations in relative strength of stocks or sectors within a predefined universe. One significant trend in the technology sector that investors should pay attention to, is the improvement of non-Mega Cap Technology stocks.

Non-Mega Cap Technology stocks are technology companies whose market capitalization is smaller than traditional tech behemoths such as Apple, Amazon, Microsoft, Google, and Facebook. These titans have been consistently outperforming the market and dominating the investment scene for a long time. However, recent RRG data indicates a potential shift in momentum towards smaller tech companies. While this doesn’t suggest a massive downswing for the tech giants, it does indicate that non-Mega Cap Technology stocks are making commendable strides and showing increasing strength relative to other stocks.

Various factors could be contributing to this emergent trend. Firstly, as we delve deeper into the digital age, there is a growing demand for innovative and specialized technologies. These offer promising opportunities for small to medium-sized tech businesses to carve a niche in the market. According to RRG data, these tech companies are already leveraging these spaces, as is evident from their relative market performance.

Secondly, the extensive disruption caused by the Covid-19 pandemic has propelled businesses of all sizes towards digital transformation. This digital push has paved the way for companies offering cloud-computing services, cybersecurity solutions, artificial intelligence, and other digital technologies to thrive. Clearly, it’s not just the tech giants that can exploit these prospects, as smaller tech companies also appear to have stepped up, as suggested by the RRG data.

Thirdly, market sentiment plays a crucial role in determining the direction of stock prices. Given the resilient market performance of the major tech companies in recent years, many investors have been questioning their high valuations. Hence, they could be looking at diversifying their portfolios with non-Mega Cap Tech stocks that might offer more reasonable valuations and robust growth potential.

RRG indices are key to identifying rotational trends in sectors, and it’s always prudent to keep an eye on these movements. The notable improvement in non-Mega Cap Tech stocks as per RRG reports serves as a good opportunity for investors to reflect on their investment strategies and make informed decisions.

However, it is essential to note that just like any other sector, non-Mega Cap Technology stocks are not immune to volatility and unpredictability. The emphasis is on comprehensive research and understanding the dynamics at play before making