Rules-Based Money Management is a method that revolves around abiding by a preset code of operations in monitoring and adjusting your financial portfolio. By adopting particular rules into your strategy, you can protect your investments from extreme risks, while also enhancing profitability. One significant technique used in rules-based money management is “trend-following”. In this article, we will dissect the essence of putting trend-following to work within your financial strategy, as part of rules-based money management.

Trend-following, as the term suggests, refers to the method of identifying and reacting to market trends to minimize losses and maximize gains. Its primary goal is to get investors to participate in substantial market moves in either direction. Notably, trend-following can be an effective instrument in rules-based money management as it can guide investors to make less emotional and more logical investment decisions.

Understanding Market Trends

The first step to incorporating trend-following in your rules-based money management strategy is understanding market trends. Three main trends generally exist: uptrends, downtrends, and sideways trends. An uptrend is identified by higher highs and higher lows, suggesting a bullish market. A downtrend, on the contrary, exhibits lower highs and lower lows, indicating a bearish market. To leverage these trends, you must understand what influences them, including fundamental market news, economic indicators, and investor sentiment.

Utilizing Trend-Spotting Tools

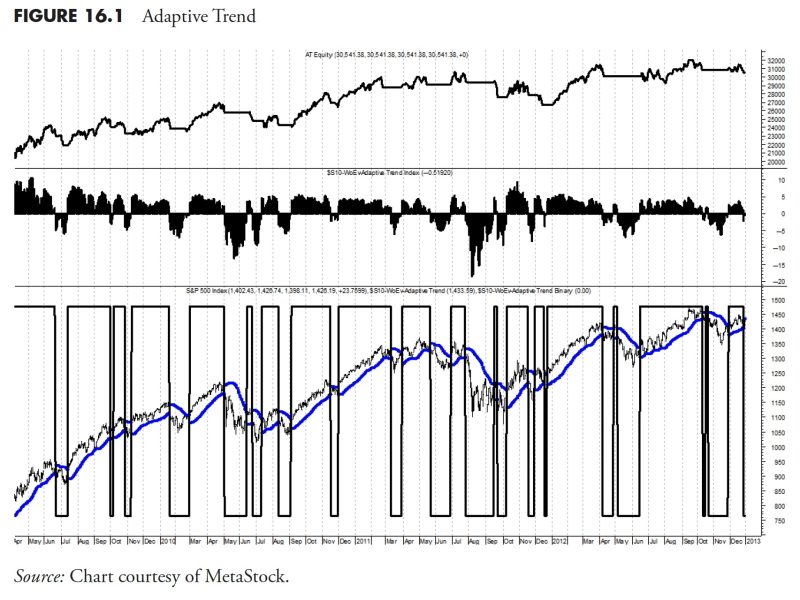

In your stride to successfully implement trend-following, you will also find a variety of trend-spotting tools invaluable. These tools can guide you in recognizing the market’s trend direction and its potential duration. Moving averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands are some of the technical analysis tools to utilize. These tools can help identify and measure market trends, which you can apply in your rules-based money management strategy.

Setting up Stop-Loss and Take-Profit Orders

The essence of trend-following is not only about hopping onto a market trend; it also involves knowing when to exit. For this purpose, stop-loss and take-profit orders are integral. A stop-loss order helps limit the potential losses if the market trend turns against your position. On the other hand, a take-profit order allows you to secure your gains once the market hits your predetermined profit target. Both these orders enforce discipline, mitigate emotional impulses, and provide an effective exit strategy in trend-following.

Following Long-term Trends

While short and intermediate trends are useful