As the stock market advances to new pinnacles daily, many investors are feeling more confident than ever about the current position of their portfolios. However, in the financial world, complacency is a dangerous status quo. It’s always important to monitor what’s happening below the surface – and currently, there’s a potential bond market surprise brewing.

Firstly, let’s dissect the most recent performance of the stock market. Encouraging corporate earnings, healthy economic data, and continued supportive policies from central banks have been significant contributors to the upward trend in equity markets. Indeed, the tech-centric Nasdaq Composite, the S&P 500 Index, and the Dow Jones Industrial Average have also been setting new records regularly, reflecting a positive sentiment among investors.

This positive trend in equities is reflected in economic data. Predictions for gross domestic product (GDP) growth remain strong, with many analysts predicting a post-pandemic recovery surge in most regions globally. Unemployment rates are dropping, and consumer confidence is on the rise – all signs of a buoyant economy.

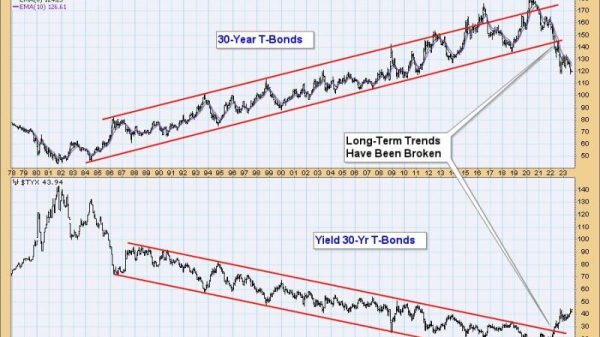

However, while the stock market’s unparalleled climb might be dominating headlines, there is underlying movement in the bond market that could have substantial implications for investors. The potential bond market surprise we are referring to comes in form of rising yields.

The yield on a bond is inversely proportional to its price. When bond yields rise, it means that the price of bonds is declining. Currently, bond yields, especially of U.S. Treasuries, are creeping higher. This might seem counterintuitive, considering the strong performance of the stock market and the somewhat dovish stance of central banks globally. Yet, the rise in bond yields is a reality, and it could disrupt the seemingly unstoppable rise of the stock market.

The principal cause of rising bond yields is the expectation of higher inflation. As economies recover post-pandemic, it is anticipated that the massive fiscal stimulus injected into economies around the world could cause a surge in inflation. Higher inflation expectations can cause bond investors to demand higher yields to offset the expected decrease in purchasing power of their future interest and principal payments. This subsequently leads to a fall in bond prices and an increase in yields.

If this bond market surprise does come to pass, it could mean several things for the stock market. First, rising bond yields could lead to higher borrowing costs for companies, which could lower corporate profits and dampen the earnings optimism that has helped to push the market higher. Second, if bond yields become