The phenomenon of volatility in the finance industry is a topic that frequently sparks discussions. Professionals across the sector recognize that it is a critical element to consider when engaged in asset valuation, portfolio management and risk assessment. However, on a more individual level, an equally hot topic of debate pans out under the theme – Is volatility risk?

Risk is an inherent part of the world of finance. As an average investor, one is exposed to various forms of risks, including interest rate risk, credit risk, liquidity risk, and market risk. Within market risk, volatility risk, the risk stemming from the changes in the volatility of asset prices, is observed. This changeability in prices can result in significant unpredictability and hence, uncertainty around returns for investors. However, one fundamental question that needs to be addressed is – is this volatility synonymous with risk?

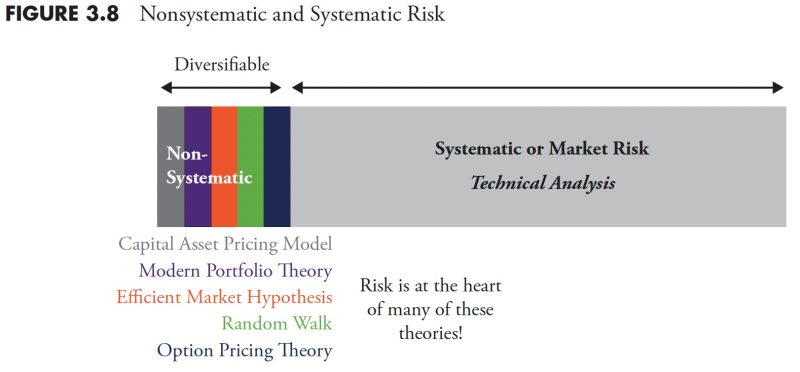

In textbook definitions, volatility is indeed interpreted as a measure of risk. Traditionally, in financial economic theory, ‘risk’ is quantified by the variability or standard deviation of returns i.e., volatility. The underlying premise is that higher the volatility (i.e., the more the price jumps up and down), the greater the risk.

Nevertheless, modern finance’s entire premise of treating volatility as risk can be seen as a hoax. There are valid reasons why volatility should not be perceived as risk. For starters, the risk in this context is perceived from an investor’s point of view as a potential loss. However, volatility, by definition, refers to both upward and downward price movements. An upward price movement does not represent the risk of a loss to an investor but is in fact a potential gain.

Further, this model of perceiving volatility as a risk falls short when one considers the time frame. Investors with a long-term perspective would be willing to absorb day to day or month to month volatility if they can see the stable journey of asset prices over a ten or twenty-year period. Thus, for a long-term investor, volatilities may have relatively inconsequential implications.

Another perspective to consider is the neglection of individual risk appetite. Modern financial theory’s standard measurement of risk as volatility tends to adopt a one-size-fits-all approach, ignoring the individual variability in terms of risk appetite and risk tolerance.

Moreover, one must also consider other risks that accompany investments, such as operational and credit risks, along with market risks such as liquidity risk. By focusing entirely on volatility, one might overlook these other significant risks, resulting in a potential misrepresentation of the entire