The financial markets have always been an arena of volatility where fortunes are created and denied as if in a blink of an eye. Nowadays, one of the profound debates among investors is focused on the potential downside risk of up to 10% for stocks as the preference swings towards value-based investing. In this context, it is prudent to explore the factors that are fostering this shift, and the potential implications for investors.

The Value vs. Growth debate has been an ongoing discussion among investors. Historically, growth stocks had been the darling of the markets, with technology companies such as Alphabet, Amazon, Apple, and Microsoft stealing the limelight due to their stellar growth potentials. However, this trend appears to be shifting as a 10% downside risk looms over stocks, pushing investors to pivot towards value investing.

The first factor fostering this change is the expected rise in interest rates. As the global economy recovers from COVID-19, central banks worldwide are considering hiking their borrowing rates. This situation influences the investment landscape as higher interest rates reduce the present value of future earnings, making growth stocks less appealing. On the contrary, value stocks are generally not as sensitive to interest rate changes, as they are often backed by tangible assets and stable income streams.

Secondly, mounting concerns over inflation are fueling this shift. As economies recover, increased government spending and demand could result in inflation. Higher prices eat into purchasing power and can negatively impact corporate earnings, particularly for growth stocks whose valuations often hinge on future earnings expectations. Conversely, value stocks often have more predictable cash flows and can be more resistant to inflation.

The ongoing global economic recovery is another contributing factor. With vaccination rates increasing and restrictions lifting, a return to pre-pandemic economic activity will lead to enhanced performance of traditional sectors like consumer goods, finance, and industrials. These sectors typically house value stocks, which could benefit more significantly from the economic recovery than growth stocks.

Expected tax reforms, particularly in the US, are another consideration. The proposed changes could affect corporate profits, again making value stocks with their more reliable returns look more attractive.

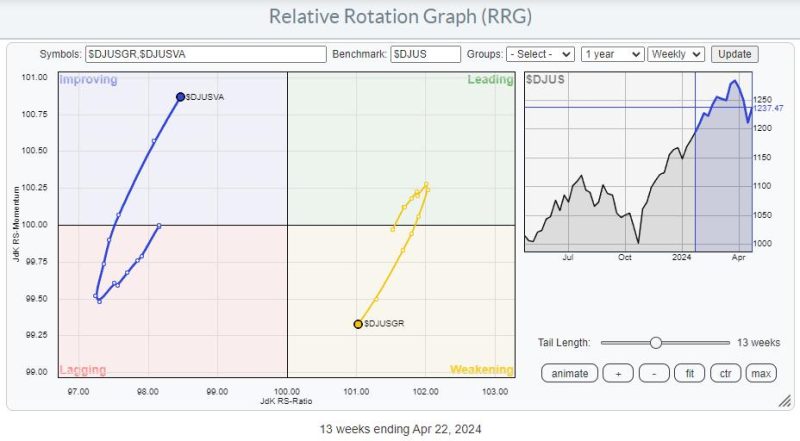

Market data also suggests a sector rotation in favor of value stocks. Certain sectors that typically contain more value stocks, such as energy, financials, and industrials, have shown substantial relative strength compared to traditional growth sectors such as technology.

Moreover, valuation discrepancies between growth and value stocks are reaching historical levels. Analysts believe this is a sign we could be nearing the end of the growth cycle