Investing with the Trend: Unraveling the Appendix

One might ponder why we focus on the functionality of an appendix – one that doesn’t exist in medical textbooks but in investment strategy. Just like its biological cousin, the trend investing appendix serves a cardinal, though often overlooked, purpose.

The Appendix in Investment Trend

Imagine the world of investment trends as a patient. The data and numbers are the pieces of the diagnosis puzzle, while the trend is the prognosis, advising where the market might go. The heart of this patient is, undeniably, an accurate and actionable strategy. And the appendix? It plays a functional role that helps maintain a healthy, profitable portfolio.

Just as an appendix in a book provides relevant, supplementary data, the appendix role in trend investing helps investors dive deeper into the nitty-gritty of the market trends, supplying them with beneficial hindsight and foresight.

Role of an Appendix in Trend Investment

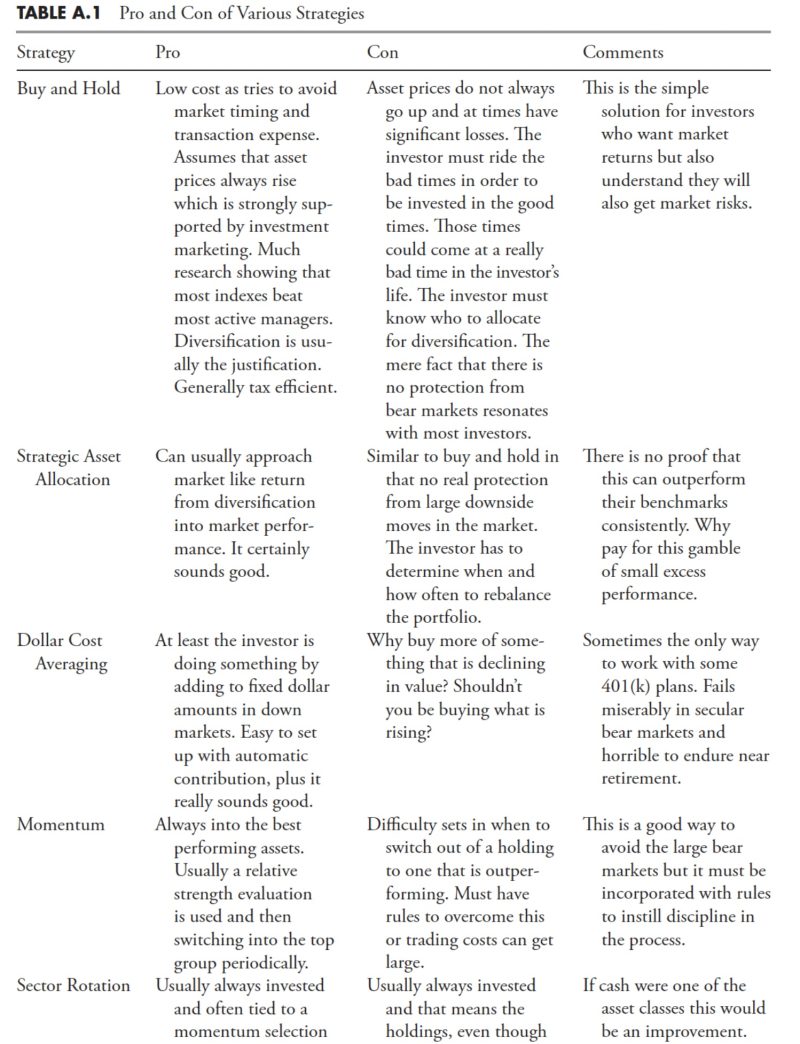

1. An In-Depth Analysis: The primary role of the appendix is to offer a detailed breakdown of data. It allows investors to delve deeper into industry-specific trends, giving them an upper hand while making educated investment choices.

2. Providing Additional Information: The appendix also provides useful information that might not fit into the idea of the main strategy, yet holds significance in the investment spectrum. It offers additional insights into fundamental factors, economic indicators, or even anomalies that can influence market trends.

3. Understanding Market Volatility: It is through the appendix that investors can grasp the concept of volatility in investment trends. For long-term investment opportunities, understanding and analyzing volatility becomes essential, and it is here where the appendix plays its role.

4. Risk Management: Crucially, the appendix helps to determine possible risks. It provides a comprehensive view of the financial stability of different sectors or even a specific company, helping investors mold their risk management strategies.

Applications of an Appendix in Trend Strategy

Investment trend strategies largely depend upon the larger timeframe. Long-term investment trends will require a more comprehensive reading of the appendix; it becomes a mirror to judge the authenticity and the feasibility of the trend that would govern the future of investments.

Contrastingly, in the case of short-term investment trends, the appendix provides insights to understand immediate changes impending in the market.

In case of sector-specific investments, the appendix will highlight the individual sector’s performance, profitability, and viability. It can help in identifying the potential areas for maximum return on investment.

Therefore, the essence of the appendix in trend