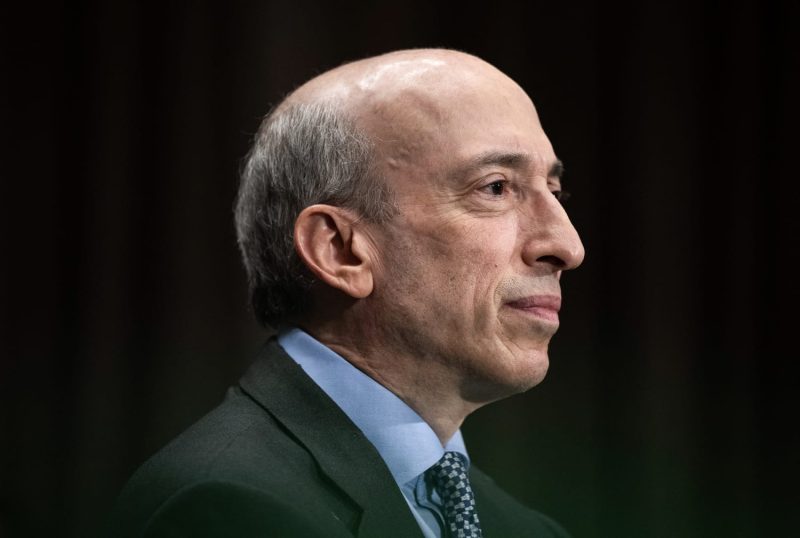

Under the purview of the Securities and Exchange Commission (SEC), one of its prominent figures, Chair Gary Gensler, has announced that he will be stepping down from his position come January 20th. His forthcoming departure marks the end of his tenured role as a notably influential figure in steering the direction of national securities regulations and policy.

Known for his relentless advocacy for the SEC’s mission of maintaining transparent, fair and functional securities markets, Gensler has been relentlessly devoted to the cause during his tenure. Appointed by President Joe Biden and confirmed by the Senate in April 2021, he brought a wealth of knowledge and experience to the SEC.

His impressive career trajectory includes time spent at the Commodity Futures Trading Commission (CFTC) from 2009 to 2014, part of which he served as the chairman. Not to mention, his professional efforts and academic accomplishments include professorship of the Practice of Global Economics and Management at the MIT Sloan School of Management and co-director of its Fintech@CSAIL initiative.

Gensler’s influence on the industry during his short tenure, has been tangible and decisive. The notable decisions, among many others, included a review of guidelines for the controversial “payment-for-order-flow” model that some brokers use, and an announcement that the SEC would prioritize enforcement actions related to issues such as climate risk and cybersecurity.

Similarly, Gensler also took aim at the burgeoning crypto sector. As a former MIT professor who taught about blockchain, his focus seemed inevitable. His expressed worries about the lack of sufficient investor protections in the crypto market garnered a mixture of praise and criticism. Yet under Gensler’s management, the SEC maintained its cornerstone principle: investor protection comes first.

Amongst Gensler’s most lasting legacies will be his guidance during the unforeseen GameStop trading frenzy in January 2021. The saga saw an unprecedented surge and subsequent drop in the video game retailer’s stock price that spooked traditional investors and regulatory institutions alike. The reaction of Gensler’s SEC demonstrated resilience and a deft touch in managing market volatility.

Ushering a new epoch for the SEC, the potential Trump administration replacement will have significant shoes to fill post-Gensler. The decision will provide a clear indication of the Trump administration’s approach to the sector – both in terms of its regulatory agenda and ethos in dealing with new market challenges like the rising cryptocurrency and fintech arenas. The shifting of Chair also brings with