1. Identifying Key Market Trends

ChartLists can be an incredibly effective tool for identifying key market trends. Investors and traders constantly need to scan an overwhelming amount of data to pick out stocks that will perform well. By utilizing ChartLists, it enables them to track the performance of a specific set of stocks over time. They can pinpoint which stocks are experiencing momentum, and which are languishing. Users can build a ChartList to track specific sectors, indices, commodities, currencies or individual stocks. This can grant early alerts of potential significant market moves and allow investors to act accordingly in a timely manner.

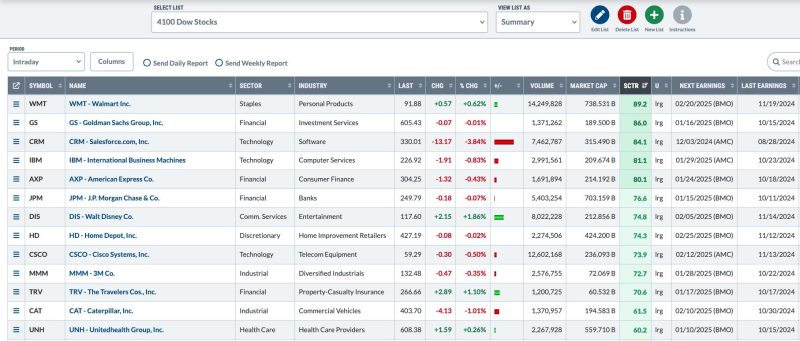

2. Utilizing ChartLists for Technically Analyzing Stocks

ChartLists can also be used for technical analysis. In other words, traders can visually study records of past market activities to forecast future market tendencies on their chosen list of securities. By having a ChartList of their favorite stocks, users can efficiently analyze each one of them looking for specific technical patterns, support/resistance levels, or indicators. Furthermore, users can use different chart types such as CandleStick, Point & Figure, or Heikin Ashi, to efficiently analyze their ChartList.

3. Showcase and Compare Performance

Another way of using ChartLists is to compare the performance of various stocks. This way, you’ll quickly see which stocks in your list are outperforming or underperforming. For example, ranking the stocks in the ChartList by percentage change can help identify the top performers and laggards over a selected timeframe. This makes it easier for you to evaluate and optimize your investment or trading strategies based on factual and reliable data. Users can also compare the performance of individual stocks to a benchmark index, such as the S&P 500, to see if they are outperforming or underperforming the market overall.

4. Portfolio Management

Modified versions of ChartLists can also be used as virtual portfolios to track the performance of your actual holdings. Investors can build a ChartList of their portfolio and get an immediate visual overview of their holdings. They can quickly see if any stock is acting abnormally, track the overall performance of their portfolio and make decisions about when to buy or sell. By maintaining this type of ChartList, users can effectively manage risk and build a well-diversified portfolio.

5. Forecasting Future Price Levels

Lastly, using ChartLists can allow an investor to predict how a certain stock will perform in the future based on charts and patterns of its past trading activities. Drawing trendlines