The Silver Futures market has offered investors the opportunity to speculate and hedge on the price of silver since the early days of the futures exchange. Silver Futures, also known as the Silver FOMC (Futures on the Silver Exchange), are futures contracts are predicated on the belief that the price of silver will increase or decrease in the near future. In this article, you will learn what Silver Futures are, how they work, and why they have become such a popular investment option in the past decade.

Silver Futures are obtained by investors on the New York Mercantile Exchange (NYMEX). This contract involves the exchange of a specific amount of silver, plus a predetermined price, for the term of a “contract.” At the expiration of the contract’s term, investors are obligated to either buy or sell the silver at the agreed upon price. Since Silver Futures are priced in US Dollars, they are traded under contract names of different sizes, denominated in ounces. The two most common contract sizes are Mini Silver contracts (1/5th of full-size) and Full-size Silver contracts (1,000 ounces).

In order to invest in Silver Futures, investors must first open a margin account with a broker. Margin accounts allow investors to have greater control over their money because it allows them to buy and sell futures contracts without having to first deposit funds into the account. When the trading in the Silver Futures market is finished, the investor pays the broker at the end of the day based on their performance.

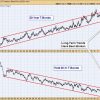

By taking the time to understand the underlying mechanics of the Silver Futures market, savvy investors can diversify their portfolios and use Silver Futures to hedge against other investments. For instance, an investor looking to preserve their wealth can use Silver Futures as a hedge against inflation. Because silver is considered one of the more historical assets, an investor can purchase silver contracts to protect profit margins should the value of the US Dollar decline against other currencies. Another use of futures is risk diversification as many investors seek to participate in the Silver Futures market by utilizing futures contracts to spread their risk across the different assets of the silver-price spectrum.

In recent years, the demand for Silver Futures has grown exponentially due to the easy access of the market and the increased liquidity it offers. Silver is one of the most traded commodities in the world and thusly, investors tend to favor silver futures over stocks, options, and other risky instruments.

Silver Futures have been used by both experienced investors and day-traders since its introduction in 2023. By investing in Silver Futures, an investor has the option of making a profit regardless of the direction of the silver market. Whether an investor predicts a rise in silver prices or a decrease in silver prices, the speculation of a price movement and the knowledge of market trends can help an investor to decide which position offers the better rate of return.

Investing in the Silver Futures market carries the underlying risk of losing money on a bad trade, however, by understanding the current trends and studying the historical price movements of silver, an investor can use the right tools and strategies to minimize this risk and maximize their potential profits. By staying well-informed, Silver Futures investors can successfully participate in the Silver FOMC and capitalize on the numerous financial benefits they offer.